In an era in which the world trembles at every presidential whim, and every sentence can ignite a chain of global events - Donald Trump shifts from being a controversial political figure to the epicenter of a systemic earthquake.

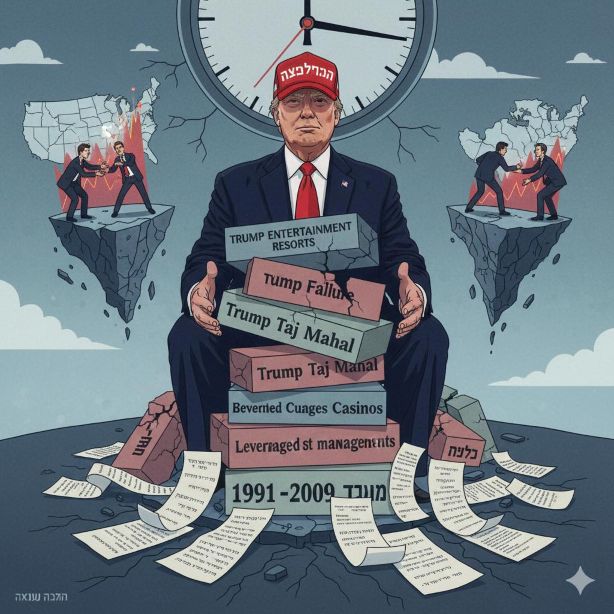

Trump’s business modus operandi - aggressive leverage, risky bets, and pushing the cost of failure onto others - in the business arena causes damage that, while painful, usually remains confined to the affected company. But when imported into the global political sphere, it ceases to be a bounded-sum game: every deliberate shock, every move designed to generate uncertainty, rapidly snowballs into a global effect that destabilizes financial, security, and institutional systems worldwide. What in business ends as a small hole in a report becomes, in policy, a shockwave that rattles entire continents.

Between 1991 and 2009, six different companies affiliated with Donald Trump filed for bankruptcy. This is not a marginal biographical detail, but evidence of a consistent pattern: aggressive leverage, large-scale gambling, and shifting the cost of failure to others. This is a model of externalizing risk and internalizing profit. When such a model is applied in the business world - the damage, severe as it may be, is usually limited. When it is applied by the president of the world’s most powerful nation - the damage becomes global, cumulative, and at times irreversible.

The real danger lies not in a single bad decision, but in the method: A policy based on deliberate shocks, uncertainty as a tactic, and the undermining of the rules of the game as a way to achieve short-term advantage. A global system - financial, security-based, and institutional - is not built to absorb such conduct over time.

Want to comment? We're waiting for you on X

Examples of possible catastrophic outcomes

- Collapse of global economic stability

One-sided gambles in the trade arena, tariff wars, or the erosion of trust in currencies and U.S. debt - may ignite a chain reaction: Capital flight, extreme market volatility, collapse of supply chains, and a sharp rise in the cost of living around the world. This is a scenario reminiscent of historical crises in which a crisis of confidence, rather than a single economic data point, brought down entire systems. - The political domino effect

When the leading global power signals that institutions, laws, and norms are flexible matters - other countries adopt the same line. The result may be a worldwide wave of forceful populism, the weakening of checks and balances, and deep damage to democracies, free-market economies, and civil rights. - Harm to dependent states, including Israel

Small and medium-sized countries that rely on American stability find themselves dragged into geopolitical gambles over which they have no control. When the gamble succeeds — the profits are concentrated at the center. When it fails - the periphery pays the price: security-wise, economically, and diplomatically.

Why this is a systemic risk - and not merely a "management style"

Systemic risk is measured not by the magnitude of the mistake, but by the scope of its contagion. And here lies the threat: a single failure does not remain local. It ripples through markets, alliances, currencies, borders, and armies.

The warning signs are already visible. Those first to identify them are not politicians or commentators, but the global financial markets — actors that operate based on cold risk assessment, not ideology. When uncertainty becomes a method, and gambling replaces responsibility, capital responds accordingly.

This is not a debate about right versus left. It is a warning about managing the world like a casino - when the pot is too large, and the cost of a fall may be one that no one can cover.

Regrettably. And in the hope that there is still time to choose stability, responsibility, and resilience - before the next gamble ends in a global disaster.